Daily Archives: July 24, 2013

Konica Minolta earns BLI Outstanding Achievement Award for Energy Efficiency

Buyers Lab awarded “Outstanding Achievement” accolades to the most energy-efficient models tested in the past eight months, with honours going to manufacturers including Konica Minolta. The winners exhibited significantly lower than average energy consumption for their respective product categories and offer a variety of environmentally friendly features to help users reduce their overall environmental impact.

After analysing the results for the top performers in a range of printer and MFP categories, BLI awarded a Summer 2013 “Outstanding Achievement” award to the Konica Minolta bizhub C284

The 28-ppm Konica Minolta bizhub C284 gave a stellar performance while running BLI’s environmental job stream test, which helped it earn its award-winning status for energy consumption. In fact, when its job stream energy was extrapolated out to one year, the unit’s projected annual energy consumption was about 41 percent lower than average for A3 colour MFPs in its speed range. But its environmental attributes don’t end at the power cord. This unit also features faster than average recovery times from overnight sleep, above average tested toner yields and a variety of features to help reduce waste, such as blank-page removal for print output. Plus, the unit enters sleep mode at its set time during an error condition—some competitive units tested stay active, consuming needless energy.

Taken from a release from buyerslab.com

Sharp’s Cash Hunt Takes Unconventional Turn

With financing options dwindling, Japan’s Sharp Corp. is reaching out to unconventional sources of capital as its search for cash gets more desperate.

- Most recently, it has asked Lixil Group Corp. –a maker of kitchen, toilet and bathroom equipment–for an investment of about ¥10 billion, one person familiar with the matter said on Friday. The electronics maker has also approached woodworking tool and lawnmower maker Makita Corp. and car parts maker Denso Corp. , according to media reports. Japan’s Nikkei newspaper also reported Sharp’s talks with Lixil. The two companies formed a joint venture in 2011 to develop and sell power-efficient equipment for installation in homes, such as all-in-one solar panel roofs and LED lights.

Traditionally, Japanese companies take care of each other’s money problems, often coming to the aid of other domestic industry peers. Sharp bought a more than 14% stake in Pioneer Corp. to help it shore its finances in 2007 (it sold those shares off amid its own troubles), and when chipmaker Renesas Technology Corp. was in need of a bailout last December Panasonic Corp. , which also has a semiconductor business, and other domestic partners chipped in.

It’s been a humbling year for Sharp, once one of the world’s largest LCD makers. Battered by mammoth losses, Sharp has slashed staff and licensed its best technology to Chinese manufacturers. It has gone cap in hand to potential partners, selling stakes in itself to arch-rival Samsung Electronics Co. , and given its banks managerial say in exchange for a lifeline. There is a concern that the loss-ridden firm may face a slow death through marginalization, however, because it still lacks the cash to invest in growth areas.

“Sharp has exhausted all partnerships that could give birth to competitive advantages in its products,” Yoshihisa Toyosaki, analyst at Tokyo-based IT consultancy firm Architect Grand Design, said. “Now, they just want the cash.”

For months, the maker of displays used in Apple Inc.’s iPads has been looking into various ways to raise funds to survive.

Late last year, Sharp and its bankers met with a U.S. private equity fund, which offered to buy a minority stake and help turn around the electronics maker, people familiar with the talks said. But the fund and the banks which control Sharp’s fate couldn’t reach an agreement, according to two people familiar with the talks.

One person involved in the negotiation said the fund and banks disagreed on whether the funds could gain access to Sharp’s assets earmarked to the lenders as loan collateral. The other person said collateral was not the main issue in their talks, adding that a private equity fund is supposed to take more risks than a bank.

Bankers also believe Sharp–for all its troubles–would be able to tap equity markets for about ¥100 billion, or $1 billion. One foreign banker not involved in talks of Sharp’ offering said, the company can issue new shares “even if the equity story is really bad.” Demand is expected to be strong among hedge funds, which have shorted Sharp and need shares to cover those short positions, the banker said. The Wall Street Journal had reported earlier that Sharp was considering an equity offering later this year.

“Nothing has been decided,” Sharp spokeswoman Miyuki Nakayama said regarding the possibility of an equity offering and of an investment from Lixil or other companies.

Sharp had a market capitalization of ¥555 billion as of Friday. The stock has risen 54% this calendar year on a surge in markets that lifted the benchmark Nikkei average by 40% and prompted a flurry of new share issues by companies such as Denso, Daiwa House, and Olympus over the last month.

Sharp, a pioneer in LCD TVs and solar power panels, has been unable to maintain its dominance in both fields as more nimble rivals took market share with aggressive marketing and pricing. Bogged down with huge advanced liquid crystal display plants in costly Japan, it logged a net annual loss of ¥545 billion in the year ended in March. It is expected to log a quarterly net loss of ¥13 billion when it reports its earnings results for April-June on August 1, according to a poll of analysts by Thomson Reuters.

In its search for funds, Sharp had expected a joint investment from Sony Corp. in its state-of-the-art Sakai plant, but Sony–struggling with its own finances–backed out of the deal. Then, it sought a tie-up with Taiwanese contract manufacturer Hon Hai Precision Industry Co. , which invested in the Sakai plant last year with an agreement to take an equity stake in Sharp too. But when more money from Hon Hai failed to materialize, Sharp turned to Samsung, which Sharp sued in 2007 for stealing its LCD technology. The Korean electronics giants acquired a 3.01% stake in Sharp in March for ¥10.4 billion. Sharp also sold a 3.53% stake in itself to U.S. chipmaker Qualcomm Inc. for a total of ¥10.8 billion over two investments with the most recent taking place at the end of June.

Originally posted @: http://blogs.wsj.com/japanrealtime/2013/07/19/sharps-cash-hunt-takes-unconventional-turn/tab/print/

The great printer in the sky: Google Cloud Print comes to Windows desktop apps

Google continues its invasion of the desktop with a new feature that lets you use the search giant’s Cloud Print service from any Windows application capable of, well, printing.

The new Google Cloud Printer is a small download that is basically a printer driver for the company’s online printing service. After the installation, you can send text documents, spreadsheets, PDFs, photos, or practically any other document you can think of from desktop applications to Google Cloud Print.

The new feature is a handy addition if you want to print a file directly from Microsoft Excel to a remote printer. Previously, Google Cloud Print worked by letting you send a file to your Cloud-connected printers from Chrome for the desktop, smartphones, and tablets. Now, you can access the service from any desktop application, such as Microsoft Office or Adobe Reader.

To get started, download Google Cloud Printer and install the EXE file like you would for any other application. After that’s done, you’ll see an option for Google Cloud Printer show up in your print options across the desktop. Google Cloud Printer will also show up as an option in modern UI applications able to print, but in my tests cloud printing from the touchy-feely side of Windows always failed.

Google

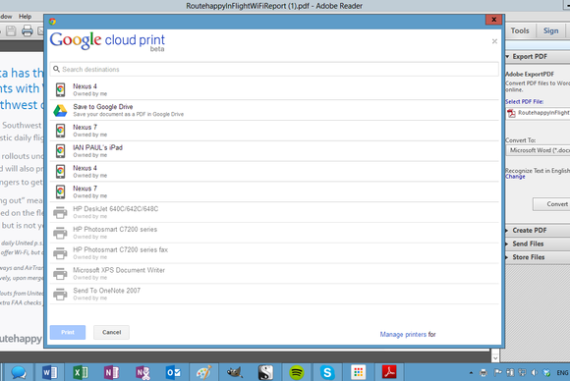

GooglePart of the reason Cloud Printer may not work with the modern UI is that you still need Chrome for the feature to work. Once you’ve chosen to print a document with Cloud Printer, a Chrome dialog box opens in a separate window asking you to pick which of your Google Cloud devices you want to receive the job. This can be any of your smartphones or tablets, Google Drive, or an actual printer connected to your Cloud Print account. But for whatever reason, modern UI applications in my tests would not kick you back to the desktop to select a printer. Perhaps this will improve over time—the Cloud Print service is still technically in beta—but for now don’t count on using the new Cloud Printer driver with Windows 8 modern UI apps.

In addition to Cloud Printer, Google also rolled out Google Cloud Print Service for Windows that lets administrators for large organizations manage Cloud-connected printers.

This is the second big Cloud Print rollout for Google this summer. Earlier, in June, Google unveiled an Android application for the company’s print anywhere service.

Originally published @: http://www.pcworld.com/article/2045009/the-great-printer-in-the-sky-google-cloud-print-comes-to-windows-desktop-apps.html#tk.rss_all